The key metrics of order intake, output, exports, and staffing have remained strongly positive for four quarters in a row, with optimism up more than half in the last three months.

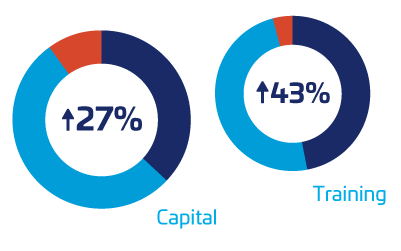

Staffing intentions remain positive at a stable rate despite the difficulties members report in securing the skills they seek, and here we see a welcome reaction to this from industry with ambitious intent for training investment, backed by increased capital investment.

Key attention points from this quarter:

- Training intent 43% positive, backed by a 14% increase in Capital Investment plans to 27%

- Staffing plans continue to be positive and stable for the fourth quarter in a row

- Order intake matches last quarter’s high at 35% positive, with forecast outlook for next 3 months rising to 43% positive

- UK and Export forecast prices reflect continued raw material and component price increases with net 74% and 61% increased respectively in the last three months

The data in this Review were acquired by a survey of Scottish Engineering’s members and certain other manufacturing companies.

31% of members responded

Companies are described as:

Small (<100 employees), Medium (100–500) and Large (>500)

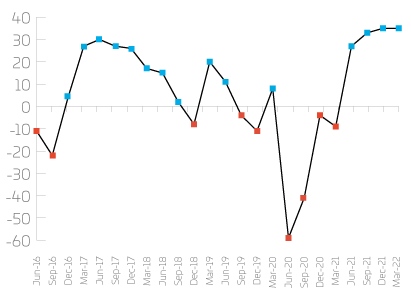

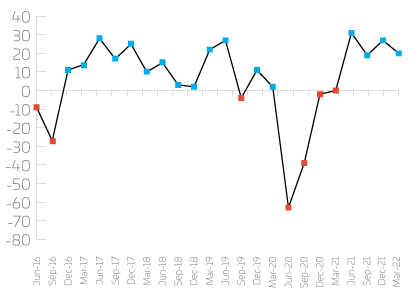

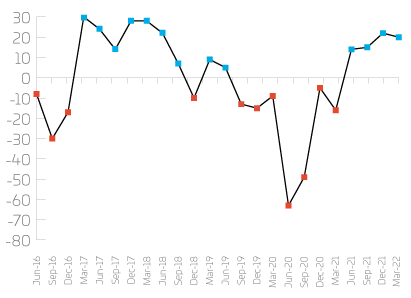

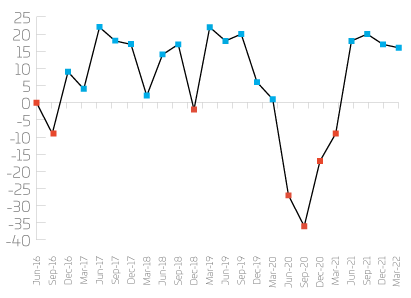

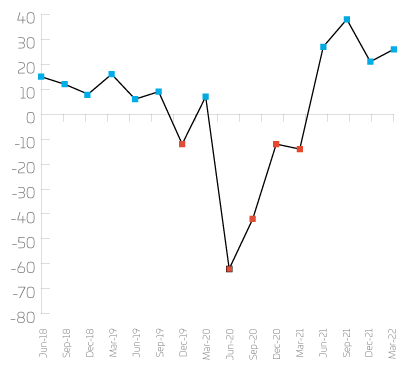

Annual trends

Order intake has remained positive at continued high levels this quarter. Output volume and exports have reduced marginally, however staffing continues to be optimistic with the balance of change at 1%. Output volume reduced by 7 percentage points which was the most significant decline from the last quarter. Exports dropped 2 percentage points from last quarter although positive overall in comparison to 2021.

Order intake

Output volume

Exports

Staffing

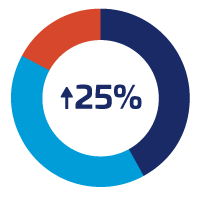

UK Orders

Net | Up | Same | Down |

25% | 42% | 41% | 17% |

UK orders continue with positivity across all sizes of company and sectors. Machine shops have improved by 38 percentage points this quarter, the most significant improvement. All sectors are reporting positive increases apart from metal manufacturing, unchanged this quarter. Positivity overall has increased, specifically for electronics, with an improvement of 52 percentage points on last quarter.

Companies | Net | Up | Same | Down |

Small | 27% | 42% | 43% | 15% |

Medium | 26% | 48% | 30% | 22% |

Large | 15% | 29% | 57% | 14% |

Sectors |

|

|

|

|

Machine | 38% | 63% | 12% | 25% |

Mechanical | 41% | 55% | 31% | 14% |

Metal | 0% | 14% | 72% | 14% |

Non-metal | 28% | 57% | 14% | 29% |

Fabricators | 30% | 40% | 50% | 10% |

Electronics | 37% | 50% | 37% | 13% |

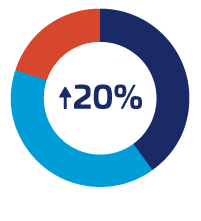

Export Orders

Net | Up | Same | Down |

20% | 40% | 40% | 20% |

Export orders are positive over all sectors and sizes except Fabricators, where the balance of change is -20% an improvement of 20 percentage points on last quarter. Machine shops, mechanical equipment and metal manufacturing are documenting the most positive balance of changes at 40%, 57% and 33% with electronics at 29%. The overall balance of change has dropped very slightly from 22% to 20% however, in comparison to 2021, remains optimistic.

Companies | Net | Up | Same | Down |

Small | 13% | 35% | 42% | 23% |

Medium | 26% | 42% | 42% | 16% |

Large | 50% | 67% | 16% | 17% |

Sectors |

|

|

|

|

Machine | 40% | 40% | 60% | 0% |

Mechanical | 57% | 68% | 21% | 11% |

Metal | 33% | 33% | 67% | 0% |

Non-metal | 20% | 40% | 40% | 20% |

Fabricators | -20% | 0% | 80% | 20% |

Electronics | 29% | 43% | 43% | 14% |

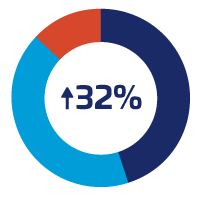

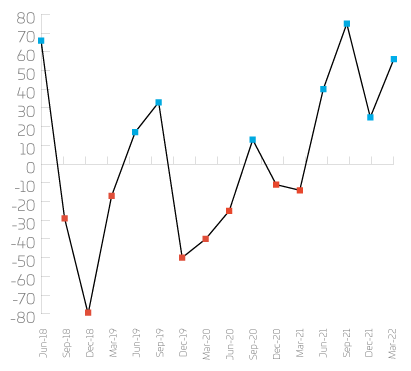

Optimism

Net | Up | Same | Down |

32% | 45% | 42% | 13% |

Optimism for all sectors remains positive with a 32% balance of change, except for metal manufacturing with a negative return, with the balance of change at -15%, falling 40 percentage points on last quarter followed by non-metal products which is down 25 percentage points since last quarter. Overall, the remaining sectors are reporting a strongly positive outlook.

Companies | Net | Up | Same | Down |

Small | 31% | 46% | 39% | 15% |

Medium | 34% | 42% | 50% | 8% |

Large | 29% | 43% | 43% | 14% |

Sectors |

|

|

|

|

Machine | 25% | 50% | 25% | 25% |

Mechanical | 39% | 43% | 53% | 4% |

Metal | -15% | 14% | 57% | 29% |

Non-metal | 0% | 29% | 42% | 29% |

Fabricators | 40% | 50% | 40% | 10% |

Electronics | 22% | 33% | 56% | 11% |

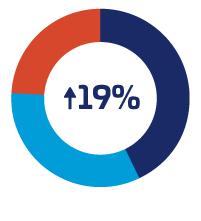

Output Volume

Net | Up | Same | Down |

19% | 43% | 33% | 24% |

Output volume remains positive with the balance of change at 19%. All sizes of company are positive, and across the sectors, all returns are positive.

Although output volume remains positive overall, the balance of change has dipped by 8% on last quarter with larger companies reporting the largest dip from 75% to 29%. Non-metal products are reporting the biggest decline from 50% to 14%. Machine shops have remained the same from last quarter.

Companies | Net | Up | Same | Down |

Small | 22% | 48% | 26% | 26% |

Medium | 12% | 33% | 46% | 21% |

Large | 29% | 43% | 43% | 14% |

Sectors |

|

|

|

|

Machine | 13% | 38% | 37% | 25% |

Mechanical | 13% | 39% | 35% | 26% |

Metal | 15% | 29% | 57% | 14% |

Non-metal | 14% | 43% | 28% | 29% |

Fabricators | 30% | 50% | 30% | 20% |

Electronics | 22% | 44% | 34% | 22% |

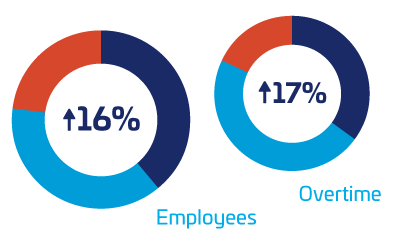

Staffing

Net | Up | Same | Down |

16% | 39% | 38% | 23% |

Employee numbers are positive for all sizes of company, and all sectors excluding machine shops who reported a net -13% this quarter. Larger companies are reporting the biggest increases at 71 percentage points.

Companies | Net | Up | Same | Down |

Small | 9% | 34% | 41% | 25% |

Medium | 17% | 42% | 33% | 25% |

Large | 71% | 71% | 29% | 0% |

Sectors |

|

|

|

|

Machine | -13% | 25% | 37% | 38% |

Mechanical | 35% | 52% | 31% | 17% |

Metal | 0% | 29% | 42% | 29% |

Non-metal | 29% | 29% | 71% | 0% |

Fabricators | 30% | 50% | 30% | 20% |

Electronics | 0% | 33% | 34% | 33% |

Overtime

Overtime working is comparative to last quarter, with small companies reporting the largest increase. This may be reflective of the medium and larger companies increase in staffing, resulting in a decline in overtime, particularly in larger companies.

Companies | Net | Up | Same | Down |

17% | 35% | 47% | 18% | |

Small | 19% | 37% | 45% | 18% |

Medium | 17% | 38% | 41% | 21% |

Large | 0% | 14% | 72% | 14% |

Investment

Net | Up | Same | Down |

27% | 37% | 53% | 10% |

Capital investment plans are markedly improved on last quarter, with majority of sectors reporting positive returns. Electronics reports a net balance 0% with increase and decrease being equal. Overall, capital investment has increased to a net balance of 27%.

Companies | Net | Up | Same | Down |

Small | 32% | 42% | 48% | 10% |

Medium | 17% | 25% | 67% | 8% |

Large | 16% | 33% | 50% | 17% |

Sectors |

|

|

|

|

Machine | 12% | 25% | 62% | 13% |

Mechanical | 39% | 48% | 43% | 9% |

Metal | 33% | 50% | 33% | 17% |

Non-metal | 29% | 43% | 43% | 14% |

Fabricators | 20% | 40% | 40% | 20% |

Electronics | 0% | 33% | 34% | 33% |

Training Investment

All sizes of company are reporting increases in training investment, a further 10% improvement from an already upbeat last quarter of 2021.

Companies | Net | Up | Same | Down |

43% | 47% | 49% | 4% | |

Small | 40% | 47% | 46% | 7% |

Medium | 42% | 42% | 58% | 0% |

Large | 71% | 71% | 29% | 0% |

Capacity Utilisation

Capacity utilisation has increased 5 percentage points to 26% since last quarter.

Order Intake Total: Electronics

Electronics order intake is positive after reporting a significant drop to 25% last quarter, indicating a robust recovery to 56%, a strong and positive recovery for the first quarter of 2022.

Forecast

Looking to the next 3 months, forecasts are extremely promising, with most measures positive however, metal manufacturing not as optimistic as other sectors, indicating a net zero balance change. The net balance of change for overall orders is 43%, UK orders 39%, export orders 29% and output volume 44% showing positivity across all order from last quarter. All sizes of company are forecasting positive figures for UK order intake, export prices, output volume and employee numbers but less positivity in figures for order export and UK prices; and across most sectors all measurements are positive. Non-metal manufacturing are the most significant showing decreases in all areas apart from output volume and electronics forecasting a decrease in price exports.

| Net | Up | Same | Down | |

Orders | 43% | 52% | 40% | 9% |

UK Orders | 39% | 47% | 45% | 8% |

Export Orders | 29% | 42% | 45% | 13% |

Output Volume | 44% | 53% | 38% | 9% |

Balance of change %

| Order Intake UK | Orders Export | Prices UK | Prices Export | Output Volume | Employees | |

|---|---|---|---|---|---|---|

| Small | 39 | 31 | 62 | 59 | 39 | 31 |

| Medium | 43 | 26 | 57 | 53 | 54 | 29 |

| Large | 29 | 17 | 71 | 67 | 57 | 86 |

| Metal Manufacturing | 0 | 17 | 71 | 67 | 57 | 29 |

| Non-Metal Products | 43 | 40 | 57 | 60 | 57 | 43 |

| Electronics | 50 | 14 | 67 | 57 | 44 | 56 |

| Fabricators | 10 | 0 | 50 | 50 | 30 | 40 |

| Machine Shops | 50 | 40 | 25 | 40 | 38 | 13 |

| Mechanical Equipment | 59 | 50 | 64 | 60 | 43 | 26 |