Key attention points from this quarter:

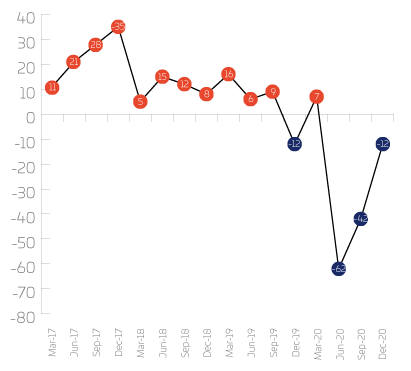

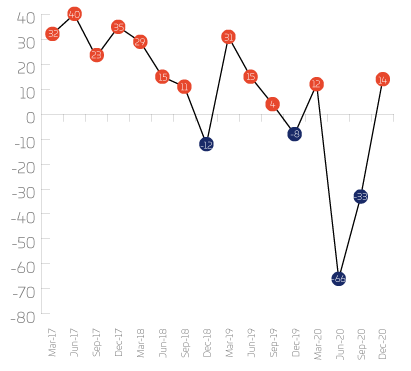

- Order intake, output volume and exports improve from average -43% to average -4%

- Companies planning further redundancies falls from 60% prior quarter to 21% with 15% unsure based on lack of forecast clarity

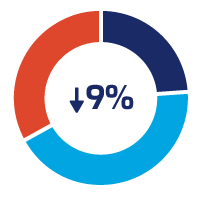

- Confidence overall improves significantly from –40% to -9%, but 33% of respondents remain negative pointing to sectors with lowest demand forecasting absence of visible recovery

- Four in ten companies (42%) are experiencing further productivity impact from Covid isolation absence

- More than half (56%) of responding companies have experienced and managed the impact of an employee attending their normal workplace and subsequently reporting a positive Covid-19 test

The data in this Review were acquired by a survey of Scottish Engineering’s members and certain other manufacturing companies.

40% of members responded

Companies are described as:

Small (<100 employees), Medium (100–500) and Large (>500)

Order intake, output volume, exports and staffing have all improved significantly since last quarter, yet remain negative. Order intake and output volume have improved by 37 percentage points, exports by 44 percentage points and staffing by 19 percentage points.

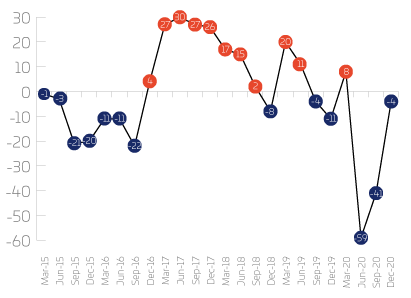

Order intake

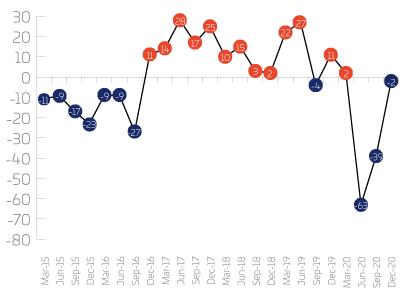

Output volume

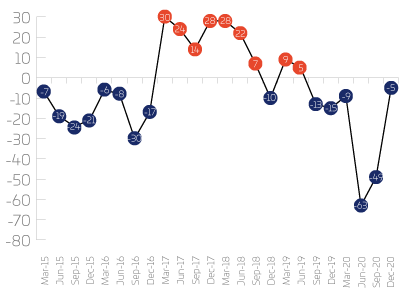

Exports

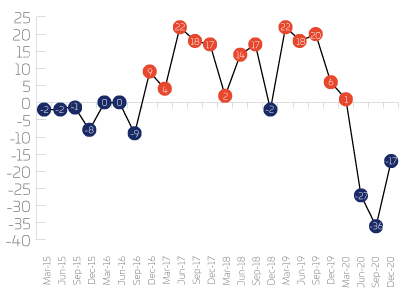

Staffing

Net | Up | Same | Down | |

UK Orders | -5% | 31% | 33% | 36% |

Small companies | -8% | 34% | 24% | 42% |

Medium | 0% | 25% | 50% | 25% |

Large companies | 0% | 0% | 100% | 0% |

Machine shops | -60% | 10% | 20% | 70% |

Mechanical | 19% | 37% | 44% | 19% |

Metal | -22% | 22% | 34% | 44% |

Non-metal | -14% | 29% | 28% | 43% |

Fabricators | 8% | 46% | 16% | 38% |

Electronics | -13% | 25% | 37% | 38% |

UK orders are negative, with the balance of change at -5%. Small companies are reporting decreases, whilst medium are reporting equal numbers of increases and decreases and large companies are reporting no change since last quarter. Within the sectors mechanical equipment and fabricators are reporting increases, but all other sectors are reporting a downturn.

Net | Up | Same | Down | |

Export Orders | -5% | 33% | 31% | 32% |

Small companies | -2% | 31% | 33% | 36% |

Medium companies | -15% | 15% | 54% | 31% |

Large companies | 33% | 33% | 67% | 0% |

Machine shops | -60% | 20% | 0% | 80% |

Mechanical | 4% | 28% | 48% | 24% |

Metal | -25% | 13% | 49% | 38% |

Non-metal | -33% | 17% | 33% | 50% |

Fabricators | -20% | 20% | 40% | 40% |

Electronics | -25% | 13% | 49% | 38% |

Export orders are negative, with the balance of change at -5%. Small and medium companies are reporting decreases whilst large companies are positive. The balance of change is -2% for small companies, -15% for medium companies, and +33% for large companies. In the sectors the balance of change is +4% for mechanical equipment, -60% for machine shops, -22% for metal manufacturing, -14% for non-metal products, -8% for fabricators and -11% for electronics.

Net | Up | Same | Down | |

Optimism | -9% | 24% | 43% | 33% |

Small companies | -15% | 24% | 37% | 39% |

Medium companies | 7% | 28% | 51% | 21% |

Large companies | 0% | 0% | 100% | 0% |

Machine shops | -60% | 0% | 40% | 60% |

Mechanical equipment | -4% | 24% | 48% | 28% |

Metal manufacturing | -22% | 11% | 56% | 33% |

Non-metal products | -14% | 43% | 0% | 57% |

Fabricators | -8% | 31% | 31% | 38% |

Electronics | -11% | 11% | 67% | 22% |

Optimism has improved 31 percentage points since last quarter, but remains negative at -9%. Small companies are reporting decreases, whilst medium companies are reporting increases and large companies have remained the same as last quarter. All sectors are reporting decreases, with machine shops and non-metal products reporting the greatest decreases.

Net | Up | Same | Down | |

Output volume | -2% | 35% | 28% | 37% |

Small companies | -3% | 36% | 25% | 39% |

Medium | -6% | 28% | 38% | 34% |

Large companies | 67% | 67% | 33% | 0% |

Machine shops | -60% | 10% | 20% | 70% |

Mechanical | 10% | 41% | 28% | 31% |

Metal | -22% | 11% | 56% | 33% |

Non-metal | -14% | 29% | 28% | 43% |

Fabricators | 0% | 38% | 24% | 38% |

Electronics | 0% | 33% | 34% | 33% |

Output volume has improved 37 percentage points since last quarter, but is still negative at -2%, small and medium companies remain negative whilst large sized companies are reporting increases of 67 percentage points. Within the sectors machine shops, metal manufacturing and non-metal products are reporting decreases; mechanical equipment are reporting increases and fabricators and electronics are reporting are reporting equal numbers of increases and decreases.

Net | Up | Same | Down | |

Staffing | -17% | 20% | 43% | 37% |

Small companies | -15% | 22% | 41% | 37% |

Medium | -20% | 14% | 52% | 34% |

Large companies | -33% | 33% | 0% | 67% |

Machine shops | -30% | 10% | 50% | 40% |

Mechanical | -6% | 28% | 38% | 34% |

Metal | -11% | 0% | 89% | 11% |

Non-metal | -62% | 13% | 12% | 75% |

Fabricators | -15% | 31% | 23% | 46% |

Electronics | -22% | 22% | 34% | 44% |

Employees

All sizes of company and all sectors have reported decreases in staffing numbers. Large companies reported the largest decrease at -33%, small companies and medium companies were slightly less, at -15% and -20% respectively.

Net | Up | Same | Down | |

Overtime | -9% | 30% | 31% | 39% |

Small companies | -13% | 31% | 25% | 44% |

Medium companies | -4% | 25% | 46% | 29% |

Large companies | 33% | 67% | 0% | 33% |

Overtime working has picked up, large companies are reporting increases, but it is still reduced for small and medium companies.

Net | Up | Same | Down | |

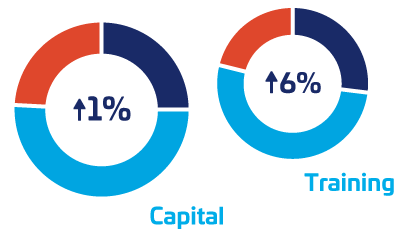

Investment | 1% | 25% | 51% | 24% |

Small companies | 1% | 26% | 49% | 25% |

Medium | -3% | 21% | 55% | 24% |

Large companies | 33% | 33% | 67% | 0% |

Machine shops | -60% | 10% | 20% | 70% |

Mechanical | 0% | 24% | 52% | 24% |

Metal | -22% | 11% | 56% | 33% |

Non-metal | 14% | 43% | 28% | 29% |

Fabricators | 31% | 38% | 54% | 8% |

Electronics | 13% | 13% | 87% | 0% |

Investment

Capital investment plans have picked up, with small and large sizes of company reporting positive net returns. Within the sectors only machine shops and metal manufacturing are reporting negative net returns.

Net | Up | Same | Down | |

Training Investment | 6% | 27% | 52% | 21% |

Small companies | 6% | 27% | 52% | 21% |

Medium companies | -3% | 21% | 55% | 24% |

Large companies | 67% | 67% | 33% | 0% |

Training investment plans have improved by 48 percentage points since last quarter, with small and large companies reporting positive figures.

Capacity Utilisation

Capacity utilisation has picked up 30 percentage points since last quarter, but remains negative at -12%.

Mechanical Equipment

Order Intake Total Mechanical equipment order intake has swung into the positive after two consecutive negative quarters.

Forecast

The last nine months have been extremely challenging for our sector but forecasts for the next three months look to improve slightly, although some measures remain negative. In general, overall orders and output volume are forecast to recover slightly, but UK orders and export orders remain negative at -3% and -17% respectively. Small companies are forecasting negative figures for orders, output and employees, but prices are expected to be positive. Medium companies are forecasting exports and employee numbers to be negative, but all other measurements are positive; and large companies are expecting exports to be negative and all other measurements positive.

Metal manufacturing, non-metal products, fabricators and mechanical equipment are forecasting an increase in U.K. order intake, whilst electronics and machine shops are forecasting a decrease. All sectors are forecasting a decrease or equal numbers of increases and decreases for export orders. The forecasts for UK pricing are positive with only metal manufacturing anticipating a decrease. Metal manufacturing, fabricators, and machine shops are forecasting a decrease in export prices, whilst non-metal products, electronics and mechanical equipment are forecasting an increase. Forecasts for output are positive from non-metal products, electronics and mechanical equipment, but other sectors are anticipating a decrease. Metal manufacturing, non-metal products and machine shops are anticipating decreases in employee numbers, whilst all other sectors are forecasting increases or equal numbers of increases and decreases.

| Net | Up | Same | Down | |

Orders | 1% | 32% | 38% | 31% |

UK Orders | -3% | 27% | 43% | 30% |

Export Orders | -17% | 19% | 45% | 36% |

Output Volume | 1% | 31% | 39% | 30% |

Balance of change %

| Order Intake UK | Orders Export | Prices UK | Prices Export | Output Volume | Employees | |

|---|---|---|---|---|---|---|

| Small | -11 | -22 | 17 | 2 | -8 | -3 |

| Medium | 11 | -8 | 21 | 12 | 14 | -7 |

| Large | 33 | -33 | 33 | 33 | 67 | 100 |

| Metal Manufacturing | 22 | -50 | -11 | -25 | -11 | -11 |

| Non-Metal Products | 14 | -50 | 71 | 33 | 43 | -38 |

| Electronics | -13 | 0 | 25 | 14 | 11 | 22 |

| Fabricators | 8 | -40 | 8 | -20 | -8 | 0 |

| Machine Shops | -40 | -20 | 0 | -40 | -30 | -40 |

| Mechanical Equipment | 4 | -19 | 29 | 20 | 3 | 3 |