Given the broader economic and societal challenges in this time frame, it’s no surprise that each quarter we brace ourselves for a potential slow down, even though the conversations have consistently supported a positive picture overall. A further pick up in optimism matches the order and output feedback, and investment and training intentions are also heading in the direction we all would like to see. Staffing intentions remind us that people are the limiting gate on growth for too many companies.

Key attention points from this quarter:

- Order intake was positive for a net 32% of members, driven by UK orders with Exports recovering from flat to single digit positive

- Output Volume was increased for 43% of companies, a net balance of 22% overall in the last quarter, with a forecast increase for 58% of businesses for a net 45% increase in the coming quarter

- Optimism increases once again with a net 23% of respondents recording increased confidence, and only 15% indicating falling optimism

The data in this Review were acquired by a survey of Scottish Engineering’s members and certain other manufacturing companies.

31% of members responded

Companies are described as:

Small (<100 employees), Medium (100–500) and Large (>500)

Annual trends

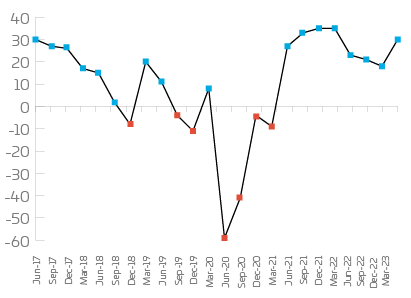

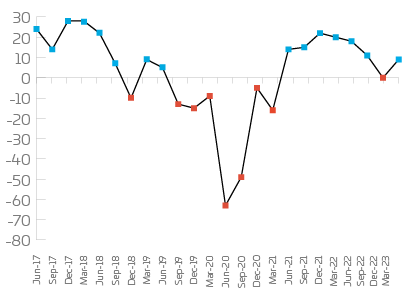

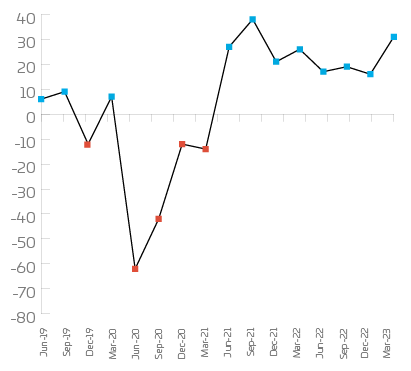

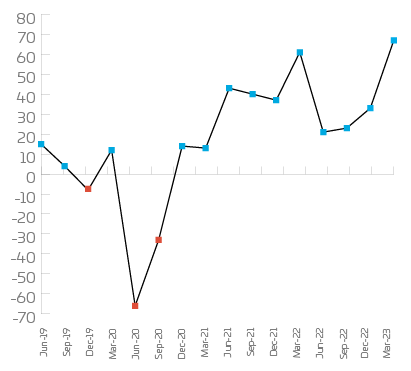

Order intake remains positive with an increase of 12% on last quarter. Output volume, exports and staffing have also increased, with exports showing a welcome 9% rise from flat last quarter. 2023 sets off with a very positive outlook for the year, with overall data in the first quarter demonstrating a confident upward trajectory. Staffing intent has increased slightly on last quarter, reflecting the continuing gap in industry to recruit staff with essential skills. The reported increased output volume (+30%) matches the increased capacity utilisation (+31%) which is above 30% for only the third time in the last eight years.

Order intake

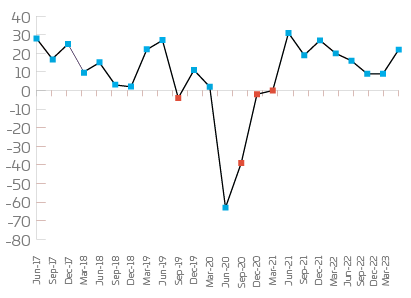

Output volume

Exports

Staffing

UK Orders

Net | Up | Same | Down |

32% | 50% | 32% | 18% |

UK orders remain positive across all sizes of companies, with medium sized companies declaring the greatest improvement at 40%. Smaller companies are not far behind with a balance of change of 30%. Most sectors remain positive with plant and machinery recording an increase of 78% this quarter. The electrical and electronics sector has improved from last quarter, and, although still negative, has improved by 18%. Precision engineering and Fabricators show positive returns, with balances of change of +33% and +31% respectively.

Companies | Net | Up | Same | Down |

Small | 30% | 48% | 34% | 18% |

Medium | 40% | 60% | 20% | 20% |

Large | 16% | 33% | 50% | 17% |

Sectors |

|

|

|

|

Manufacturing | 18% | 41% | 36% | 23% |

Plant & Machinery | 78% | 78% | 22% | 0% |

Metal | 20% | 40% | 40% | 20% |

Precision | 33% | 33% | 67% | 0% |

Fabricators | 31% | 46% | 39% | 15% |

Electrical & Electronics | -11% | 33% | 23% | 44% |

Export Orders

Net | Up | Same | Down |

9% | 37% | 35% | 28% |

Export orders for larger companies has improved on last quarter by 50%. Small companies show a slight decline with a balance of change of -2%. Medium companies show a healthy increase in their balance of change by 25%. Precision Engineering, Plant & Machinery and Manufacturing are recording positive balances of change at 60%, 29% and 10%. Metal Products, Electrical & Electronics and Fabricators show a decline with balances of change of -50%, -42% and -16% resulting in a balance of change increasing from 0% to 9% overall.

Companies | Net | Up | Same | Down |

Small | -2% | 33% | 32% | 35% |

Medium | 21% | 43% | 35% | 22% |

Large | 50% | 50% | 50% | 0% |

Sectors |

|

|

|

|

Manufacturing | 10% | 35% | 40% | 25% |

Plant & Machinery | 29% | 43% | 43% | 14% |

Metal | -50% | 25% | 0% | 75% |

Precision | 60% | 60% | 40% | 0% |

Fabricators | -16% | 17% | 50% | 33% |

Electrical & Electronics | -42% | 29% | 0% | 71% |

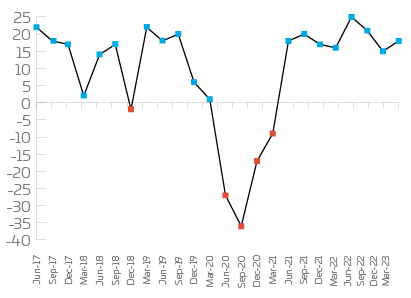

Optimism

Net | Up | Same | Down |

23% | 38% | 47% | 15% |

Optimism is a welcome positive with an improvement of 9% on last quarter. For the second quarter in a row, medium companies remain the most optimistic with a 38% balance of change, an improvement of 14% on last quarter. Small companies report a balance of change of 18%, with larger companies slightly lower at 14%. The majority of sectors remain positive in their optimistic outlook with Plant & Machinery and Metal Products showing the strongest optimism with +34% and +27% respectively. Electrical & Electronics show a negative return for the second quarter in a row at -22%, a decline from -11% last quarter. Overall, optimism has increased by 9% since last quarter.

Companies | Net | Up | Same | Down |

Small | 18% | 35% | 48% | 17% |

Medium | 38% | 46% | 46% | 8% |

Large | 14% | 43% | 28% | 29% |

Sectors |

|

|

|

|

Manufacturing | 27% | 42% | 43% | 15% |

Plant & Machinery | 34% | 56% | 22% | 22% |

Metal | 20% | 60% | 0% | 40% |

Precision Engineering | 17% | 17% | 83% | 0% |

Fabricators | 15% | 29% | 57% | 14% |

Electrical & Electronics | -22% | 11% | 56% | 33% |

Output Volume

Net | Up | Same | Down |

22% | 44% | 34% | 22% |

Output volume remains positive at +13% overall. Small and medium companies are showing positivity (23% and 27% respectively) with larger companies, a decline of -17% overall. Manufacturing has seen the largest improvement since last quarter with a +41% improvement, with Fabricators closely behind with a +39% improvement on last quarter. Metal products report equal positive and negative returns. Overall, output volume has increase by 13% on last quarter.

Companies | Net | Up | Same | Down |

Small | 23% | 45% | 33% | 22% |

Medium | 27% | 46% | 35% | 19% |

Large | -17% | 17% | 49% | 34% |

Sectors |

|

|

|

|

Manufacturing | 28% | 40% | 48% | 12% |

Plant & Machinery | 11% | 33% | 45% | 22% |

Metal | 0% | 40% | 20% | 40% |

Precision | -17% | 17% | 49% | 34% |

Fabricators | 29% | 36% | 57% | 7% |

Electrical & Electronics | -33% | 22% | 23% | 55% |

Staffing

Net | Up | Same | Down |

18% | 35% | 48% | 17% |

Employee numbers are positive for small (+20%) and medium (+19%) sizes of companies, with larger companies reporting a decline of 80% on last quarter. This figure indicates the ongoing issues with recruitment and filling vacancies. Electrical and Electronics are reporting the biggest issue in recruiting with a decline of -33%.

Companies | Net | Up | Same | Down |

Small | 20% | 32% | 56% | 12% |

Medium | 19% | 42% | 35% | 23% |

Large | 0% | 43% | 14% | 43% |

Sectors |

|

|

|

|

Manufacturing | 16% | 31% | 54% | 15% |

Plant & Machinery | 22% | 44% | 34% | 22% |

Metal | 0% | 20% | 60% | 20% |

Precision | 16% | 33% | 50% | 17% |

Fabricators | 14% | 21% | 72% | 7% |

Electrical & Electronics | -33% | 0% | 67% | 33% |

Overtime

Overtime working is comparative to last quarter, with medium companies reporting the largest increase for the second quarter running at 26%, smaller companies at 5% and larger companies a decline of -16%. Smaller and medium sized companies overtime has increased, in line we would suggest with their high levels of UK orders (+30% and +40%).

Companies | Net | Up | Same | Down |

9% | 27% | 55% | 18% | |

Small | 5% | 24% | 57% | 19% |

Medium | 26% | 38% | 50% | 12% |

Large | -16% | 17% | 50% | 33% |

Investment

Net | Up | Same | Down |

15% | 32% | 51% | 17% |

Capital investment plans remain positive with a slight increase on last quarter – all sizes of companies and the majority of sectors are reporting positive returns. Smaller companies are reporting the largest increase with a +19% balance of change with larger companies slightly behind with a +17% balance of change. Electrical & electronics remain static on last quarter but remain the most optimistic with their plans, with a balance of change of +38%. Overall, the balance of change is +15%, increasing 2% from last quarter.

Companies | Net | Up | Same | Down |

Small | 19% | 36% | 47% | 17% |

Medium | 4% | 19% | 66% | 15% |

Large | 17% | 50% | 17% | 33% |

Sectors |

|

|

|

|

Manufacturing | 27% | 35% | 57% | 8% |

Plant & Machinery | 0% | 33% | 34% | 33% |

Metal | -20% | 20% | 40% | 40% |

Precision | 17% | 17% | 83% | 0% |

Fabricators | 0% | 23% | 54% | 23% |

Electrical & Electronics | 38% | 38% | 62% | 0% |

Training Investment

All sizes of company are reporting increases in training investment, with a further +30% intention carrying on from the previous quarter’s upbeat outlook.

Companies | Net | Up | Same | Down |

30% | 36% | 58% | 6% | |

Small | 27% | 34% | 59% | 7% |

Medium | 35% | 38% | 59% | 3% |

Large | 43% | 43% | 57% | 0% |

Capacity Utilisation

Capacity utilisation has increased to 31% since last quarter, 15% more than last quarter’s increase.

Plant & Machinery

Plant & Machinery order intake remains positive with a steady increase since Q2 of 2022. This quarter shows an improvement of 34%. This is the best increase recorded for the sector for several years, showing a positive and welcome recovery for the industry.

Forecast

Looking at the next 3 months, forecasts remain positive for all company sizes in most areas. Plant & Machinery’s outlook is the most promising in all areas except for Orders export which remains flat, however, they show the highest increases in Order intake (+56%), Prices UK (+56%), Prices export (+50%), Output volume (+67%) and employees (+33%). Precision Engineering shows the largest increase in Employees (+83%) and is equal in Output volume (+67%) and Prices UK (+50%). Medium sized companies are still showing the highest in UK prices (+48%), representing a decline of 15% from last quarter. Order intake remains a concern for Metal Products with another decline in the quarter of 40%, an increase of -15% from last quarter and Electrical & Electronics reporting a similar decline this quarter of -33% (+20% last quarter) – the worst decline this quarter with a balance of change of -53%. Prices Export and Prices UK indicates positivity for all sizes of company and all sectors. Larger companies optimism for recruitment shows a decline from last quarter at -14% but their optimism remains high for order and price exports, both at +50%. In summary, this quarter shows that all size of company and sectors are forecasting improvements in most areas for the coming quarter.

| Net | Up | Same | Down | |

Orders | 26% | 46% | 34% | 20% |

UK Orders | 22% | 41% | 40% | 19% |

Export Orders | 13% | 37% | 39% | 24% |

Output Volume | 45% | 58% | 29% | 13% |

Balance of change %

| Order Intake UK | Orders Export | Prices UK | Prices Export | Output Volume | Employees | |

|---|---|---|---|---|---|---|

| Small | 26 | 15 | 40 | 27 | 39 | 35 |

| Medium | 12 | 4 | 48 | 39 | 62 | 38 |

| Large | 17 | 50 | 33 | 50 | 33 | -14 |

| Metal Products | -40 | 0 | 20 | 25 | 0 | 40 |

| Precision Engineering | 33 | 20 | 50 | 20 | 67 | 83 |

| Electrical & Electronics | -33 | 0 | 33 | 14 | -22 | 0 |

| Fabricators | 23 | -17 | 36 | 0 | 36 | 7 |

| Manufacturing | 26 | 38 | 38 | 36 | 58 | 20 |

| Plant & Machinery | 56 | 0 | 56 | 50 | 67 | 33 |