Order intake is joined by output volume and staffing for a now seven straight quarters of positive scores, and even optimism returns to being above the line after flatlining in September. Later we will assess what could be driving those unexpected positives.

Key attention points from this quarter:

- Order intake was positive for a net 18% of members, driven by UK orders with Export neither positive nor negative

- Output Volume was increased for 36% of companies, a net balance of 9% overall, with a forecast increase for a net 26% of businesses in the coming quarter

- Optimism turns positive once again with a net 14% of respondents recording increased confidence, up from a neutral net 0% last quarter

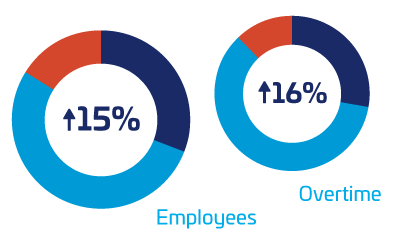

- A further quarter of staffing increases at net 15% underlines our sector’s biggest challenge in growing, finding, recruiting and retaining skilled staff.

The data in this Review were acquired by a survey of Scottish Engineering’s members and certain other manufacturing companies.

30% of members responded

Companies are described as:

Small (<100 employees), Medium (100–500) and Large (>500)

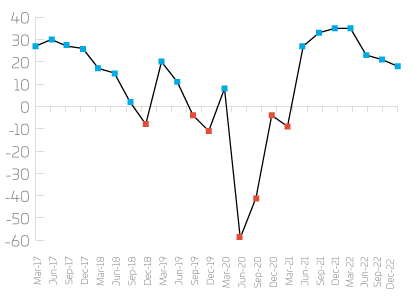

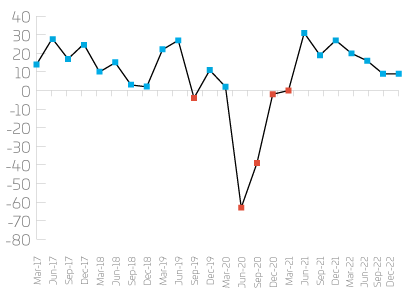

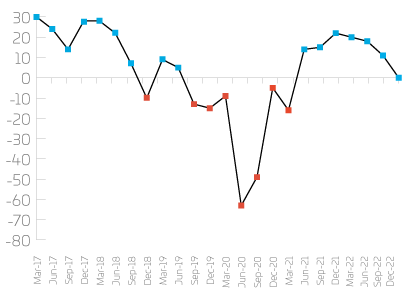

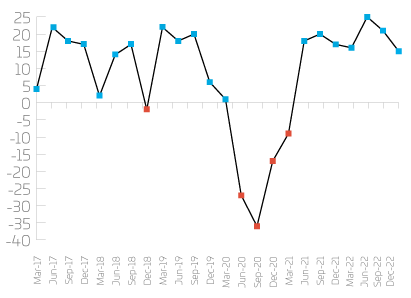

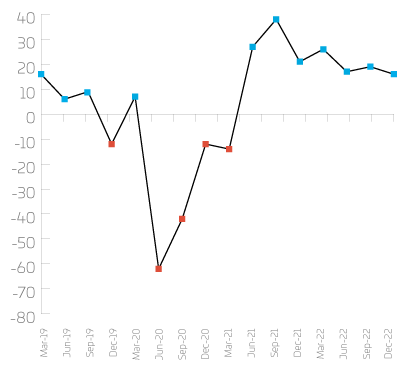

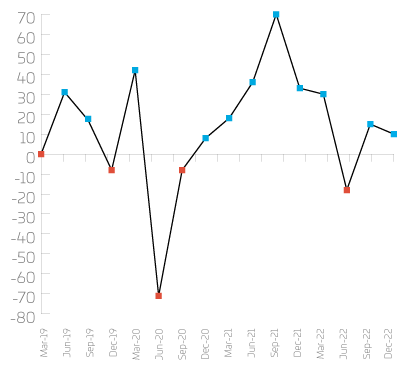

Annual trends

Order intake remained positive albeit at a slightly reduced level than recent quarters. Output volume also remains positive from last quarter at the same rate of increase, whilst exports showing a -11% balance of change on the previous quarter. Staffing remained positive although softening by 6%. The overall outlook from the data in third quarter shows a notable seventh straight quarter of positive indices, albeit somewhat softening. Exports appear the biggest challenge with the greatest decline this quarter. Optimism within the industry remains positive in most sectors notwithstanding the challenges of increasing prices, most notably the increase in energy prices.

Order intake

Output volume

Exports

Staffing

UK Orders

Net | Up | Same | Down |

11% | 39% | 33% | 28% |

UK orders continue with positivity across small sized companies, with medium and larger sized companies’ static in their increase rate quarter or on quarter. Most sectors remain positive except for Electrical & Electronics where a net 29% of companies reported reductions. Manufacturing shows a slight decline with a -5% balance of change, with all other sectors reporting positive returns.

Companies | Net | Up | Same | Down |

Small | 18% | 46% | 26% | 28% |

Medium | 0% | 30% | 40% | 30% |

Large | 0% | 20% | 60% | 20% |

Sectors |

|

|

|

|

Manufacturing | -5% | 32% | 32% | 36% |

Plant & Machinery | 22% | 45% | 33% | 22% |

Metal | 0% | 25% | 50% | 25% |

Precision | 38% | 50% | 37% | 13% |

Fabricators | 10% | 40% | 30% | 30% |

Electrical & Electronics | -29% | 0% | 71% | 29% |

Export Orders

Net | Up | Same | Down |

0% | 24% | 52% | 24% |

Export orders remain positive for small sized companies. Larger companies remain flat with an equal balance of companies gaining and falling, and medium companies show a slight decline with a balance of change of -4%. Plant & Machinery, Electrical & Electronics and Manufacturing are recording the most positive balances of change at 29%, 14% and 5%. Metal products, Fabricators and Precision Engineering show a decline with balances of change of -25%, -20% and -17% meaning the balance of change dropping from 11% to 0% overall.

Companies | Net | Up | Same | Down |

Small | 3% | 27% | 49% | 24% |

Medium | -4% | 20% | 56% | 24% |

Large | 0% | 25% | 50% | 25% |

Sectors |

|

|

|

|

Manufacturing | 5% | 26% | 53% | 21% |

Plant & Machinery | 29% | 57% | 14% | 29% |

Metal | -25% | 0% | 75% | 25% |

Precision | -17% | 0% | 83% | 17% |

Fabricators | -20% | 0% | 80% | 20% |

Electrical & Electronics | 14% | 29% | 57% | 14% |

Optimism

Net | Up | Same | Down |

14% | 33% | 48% | 19% |

Optimism remains positive with an improvement of 14% on last quarter. Medium companies are the most optimistic with a 24% balance of change, small companies 10% and larger companies report equal positive and negative returns. Manufacturing and Precision Engineering shows the strongest optimism with 29% and 13% respectively. Metal products and Fabricators show a negative return this quarter with -25% and -30%.

Companies | Net | Up | Same | Down |

Small | 10% | 30% | 50% | 20% |

Medium | 24% | 41% | 42% | 17% |

Large | 0% | 20% | 60% | 20% |

Sectors |

|

|

|

|

Manufacturing | 29% | 46% | 37% | 17% |

Plant & Machinery | -11% | 11% | 67% | 22% |

Metal | -25% | 25% | 50% | 25% |

Precision Engineering | 13% | 25% | 62% | 13% |

Fabricators | -30% | 10% | 50% | 40% |

Electrical & Electronics | -11% | 11% | 67% | 22% |

Output Volume

Net | Up | Same | Down |

9% | 32% | 45% | 23% |

Output volume remains positive at +9%, consistent with last quarters figure. Small and larger companies are showing positivity with larger companies displaying an improvement of +40%. Medium companies are reporting a decline of -7% overall. Precision Engineering remain the most positive, with a 50% balance of change followed by Plant & Machinery at 11%. All other sectors show a decline with negative balances of change.

Companies | Net | Up | Same | Down |

Small | 14% | 37% | 39% | 24% |

Medium | -7% | 18% | 57% | 25% |

Large | 40% | 40% | 60% | 0% |

Sectors |

|

|

|

|

Manufacturing | -13% | 21% | 46% | 33% |

Plant & Machinery | 11% | 33% | 45% | 22% |

Metal | -25% | 0% | 75% | 25% |

Precision | 50% | 50% | 50% | 0% |

Fabricators | -10% | 20% | 50% | 30% |

Electrical & Electronics | -14% | 14% | 57% | 29% |

Staffing

Net | Up | Same | Down |

15% | 31% | 53% | 16% |

Employee numbers intention are positive for all sizes of company, with most of the sectors, reflecting ongoing difficulty to recruit for vacancies. Larger companies are reporting an 80% increase overall since last quarter followed by medium companies with +17% and smaller companies at +8%.

Companies | Net | Up | Same | Down |

Small | 8% | 25% | 59% | 16% |

Medium | 17% | 34% | 49% | 17% |

Large | 80% | 80% | 20% | 0% |

Sectors |

|

|

|

|

Manufacturing | 13% | 25% | 62% | 13% |

Plant & Machinery | 33% | 44% | 45% | 11% |

Metal | -25% | 25% | 25% | 50% |

Precision | 25% | 38% | 49% | 13% |

Fabricators | 0% | 10% | 80% | 10% |

Electrical & Electronics | -11% | 11% | 67% | 22% |

Overtime

Overtime working is comparative to last quarter, with medium companies reporting the largest increase at 21%, larger companies at 20% and smaller companies at 13%. This may be reflective of all sizes of companies struggling to increase staffing, resulting in use of overtime to meet demand. Smaller companies are reporting a 10% decline since last quarter, whilst larger companies have not only increased staff by 80%, but overtime has increased by 20% on last quarter showing positivity for this size of company.

Companies | Net | Up | Same | Down |

16% | 28% | 60% | 12% | |

Small | 13% | 27% | 58% | 15% |

Medium | 21% | 31% | 59% | 10% |

Large | 20% | 20% | 80% | 0% |

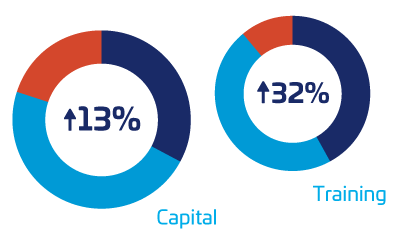

Investment

Net | Up | Same | Down |

13% | 33% | 47% | 20% |

Capital investment plans remain positive albeit at a lower rate of increase on last quarter – the majority of sectors are reporting positive returns. Larger companies are reporting the biggest increase with a +60% balance of change. Overall, the net positive balance is +13%, increasing 4 percentage points less than last quarter.

Companies | Net | Up | Same | Down |

Small | 9% | 33% | 42% | 25% |

Medium | 14% | 28% | 58% | 14% |

Large | 60% | 60% | 40% | 0% |

Sectors |

|

|

|

|

Manufacturing | 17% | 30% | 57% | 13% |

Plant & Machinery | 11% | 44% | 23% | 33% |

Metal | -25% | 25% | 25% | 50% |

Precision | 25% | 25% | 75% | 0% |

Fabricators | -40% | 0% | 60% | 40% |

Electrical & Electronics | 38% | 38% | 62% | 0% |

Training Investment

All sizes of company are reporting increases in training investment, returning to the levels displayed in Q2, 2022, an increase of 5 percentage points on last quarter.

Companies | Net | Up | Same | Down |

32% | 42% | 47% | 11% | |

Small | 24% | 40% | 44% | 16% |

Medium | 41% | 45% | 52% | 3% |

Large | 60% | 60% | 40% | 0% |

Capacity Utilisation

Capacity utilisation has increased 16% since last quarter, 3% less than last quarter’s increase.

Order Intake Total: Fabricators

Fabricators order intake remains positive at a lower rate of increase than last quarter. It does however, show an improvement on quarter two of 28 percentage points. After this slight decline, their recovery from quarter two is a welcome one, nevertheless, they still have not reached the full capacity shown in 2021.

Forecast

Looking at the next 3 months, forecasts remain positive for all company sizes with a forecast 20% increase in orders driven by UK business, and output volume matching this. Export remains a concern as this shows flat quarter on quarter despite domestic growth. Medium size companies showing the highest increases in UK prices (+63%), export prices (+64%), output volume (+46%) and order intake (+33%). The forecast change for this size of companies overall orders is +16%, UK orders +17%, export orders +5% and output volume +26%, a slight decline on last quarters figures but remains positive. Metal Products report a 75% increase in UK prices and export prices respectively, whilst manufacturing reports UK prices increasing +61% and export prices +60%.

| Net | Up | Same | Down | |

Orders | 16% | 33% | 50% | 17% |

UK Orders | 17% | 33% | 51% | 16% |

Export Orders | 5% | 21% | 62% | 17% |

Output Volume | 26% | 41% | 44% | 15% |

Balance of change %

| Order Intake UK | Orders Export | Prices UK | Prices Export | Output Volume | Employees | |

|---|---|---|---|---|---|---|

| Small | 9 | -11 | 47 | 41 | 17 | 28 |

| Medium | 33 | 24 | 63 | 64 | 46 | 24 |

| Large | 20 | 25 | 60 | 50 | 20 | 40 |

| Metal Products | -25 | 0 | 75 | 75 | -50 | 0 |

| Precision Engineering | 13 | 0 | 38 | 29 | 50 | 25 |

| Electrical & Electronics | 14 | -14 | 29 | 29 | 14 | 22 |

| Fabricators | 20 | 0 | 40 | 40 | 20 | 20 |

| Manufacturing | 18 | 10 | 61 | 60 | 29 | 17 |

| Plant & Machinery | 33 | 0 | 44 | 57 | 33 | 33 |